Definition of Activity Based Costing

- Download Danone Driver App

- Download Danone Drivers

- Download Danone Driver Download

- Download Danone Driver Job

What is Activity Based Costing? How does Activity Based Costing work?

- Free download driver 7.2mbps 3g hsdpa usb modem driver download Shenzhen Hwnet Times Tech Co., Ltd. US $7.00-$10.00 / Piece.

- Create your InMusic Profile. Denon DJ is part of an elite family of hardware and software companies known as inMusic Brands. The inMusic Profile is where you can register products, download software titles, and access exclusive content and offers - not just for Denon DJ, but for any brands within the inMusic network!

- Danone's subsidiaries and equity holdings as of December 31, 2019. List of Subsidiaries 2019 Ownership M&A/Partnerships.

Activity-based costing (ABC) is an accounting approach that enables Danone to assign overhead activities costs of the firm to the specific products and services it produces & delivers.

Compare to the traditional approach, ABC assigns the overheads and indirect costs less arbitrarily and focuses on true relationship between costs, overhead activities, and related products (manufactured, produced) / services delivered by Danone.

Solving Danone Costing Problem with ABC Accounting Method

Danone markets two types of products in the Food Processing industry. For sake of simplicity let us call them Consumer/Non-Cyclical Standard product and Consumer/Non-Cyclical Custom Product. Standard Product is lot simpler than Custom Product, so Danone produces Standard product in large batch sizes compare to Custom product which is produced in smaller batch sizes.

Anz Investor Relations Events free download - Lexa Organizer, Inchcape Investor Relations, Danone Investor Relations, and many more programs.

Download Danone Driver App

| Danone Standard Product | Danone Custom Product | |

|---|---|---|

| Annual Sales (Units) | 12070 | 11110 |

| Sales Price (Per Unit) | 64 USD | 90 USD |

| Batch Size (units) | 1000 | 50 |

| Direct Labor Time / per unit | 2 | 2.5 |

| Direct Labour rate per hour | 8 | 8 |

| Direct Input cost per unit | 22 | 32 |

| Number of Custom Parts per unit | 1 | 4 |

| Number of Set-Ups per batch | 1 | 3 |

| Separate Material per batch | 1 | 1 |

| Number of Sales Invoices - issued per year | 50 | 240 |

| Overhead Cost Analysis | USD | Cost Drivers |

|---|---|---|

| Set Up Costs | 72518 | Number of Set Ups |

| Special part handling cost | 60395 | Number of Special Parts |

| Customer invoicing cost | 29303 | Number of Invoices |

| Material handling cost | 62160 | Number of Batches |

| Other overheads | 107613 | Labor Hours |

Urgent - 6Hr

- 100% Plagiarism Free

- On Time Delivery | 27x7

- PayPal Secure

- 300 Words / Page

12 Hr Delivery

- 100% Plagiarism Free

- On Time Delivery | 27x7

- PayPal Secure

- 300 Words / Page

24 Hr

- 100% Plagiarism Free

- On Time Delivery | 27x7

- PayPal Secure

- 300 Words / Page

Solution Based on Traditional Approach of Costing

Traditional Approach - Absorption Approach

The difference between the traditional method and ABC can be only noticed when there are different types of products produced by Danone and indirect costs comprise a significant chunk of the overall cost structure of Danone.

One of the key reasons why small firms still use traditional method is its sheer simplicity. ABC can be highly complex if the firm is present in number of industries and, produce & market various products around firm's core competency.

How direct costs are treated in ABC? Is it different from the way it is treated under traditional approach?

The answer is no difference at all. ABC is concerned only with the way in which overheads are charged to jobs to derive the full cost.

Step 1 - Calculating Overhead Recovery Rate of Indirect Costs

| Overhead Cost Analysis | USD |

|---|---|

| Set Up Costs | 72518 |

| Special part handling cost | 60395 |

| Customer invoicing cost | 29303 |

| Material handling cost | 62160 |

| Other overheads | 107613 |

| Total Overheads (1+2+3+4+5) | 331989 |

To calculate the 'Overhead Recovery Rate' add up all the indirect costs that Danone is incurrring for both the standard and custom product.

Overhead Recovery Rate Formula

Overhead Recovery Rate = Total Overheads / Number of Labor Hours

Overhead Recovery Rate = 6.39 Per Hour

Step 2 - Product / Service Costs - Adding Direct and Indirect Costs

| Standard Product | Custom Product | |

|---|---|---|

| Direct Costs | ||

| Labor Hrs * Labor/hr | 16 | 20 |

| Material | 22 | 32 |

| Indirect Costs | ||

| Overheads (recovery rate * hours) | 12.78 | 15.975 |

| Total Costs Per Unit (1+2+3) | 50.78 | 67.975 |

Using the Overhead Recovery Rate Calculation we can assign the indirect cost to individual products. We are just allocating the variable or indirect costs based on the hours taken by labor to produce the standard and custom products.

Total cost per unit under the traditional method can be calculated by adding up - Raw material costs, labor costs, and indirect cost allocation using Overhead Recovery Rate formula.

The Total Cost per unit of Standard product is 50.78

The Total Cost per unit of Custom product is 67.975

Return on Sales Calculations for Danone

Return on Sales metrics enables the firm to allocate resources where it can maximize returns. After subtracting the cost per unit of the product from sales price of the product we can arrive at the profit per unit.

| Standard Product | Custom Product | |

|---|---|---|

| USD per Unit | USD per Unit | |

| Selling Price | 64 | 90 |

| Total Cost | 50.78 | 67.975 |

| Profit | 13.22 | 22.025 |

| Return on Sales | 20.66 | 24.472 |

The profit per unit of custom product is higher than standard product.In isolation these numbers don't provide a great insight as price is often the function of competitive forces in the market place. To explore further we should analyze - Return on Sales per unit.

Activity Based Costing System for Danone

Activity Based Costing can improve the costing process at Danone in three prominent ways –

By increasing the number of cost pools – ABC help in identifying the activities that are being performed by organization’s resources. Often too narrow allocation can result in unclear understanding of both activities and how resources spent on them.

By assigning costs to various activities that are segmented based on the role they perform in overall processes. Instead of treating all indirect costs as one organization wide pool, ABC pools the costs based on each activity.

Finally assigning costs to respective products, service and customers activities in the organization using activity cost drivers.

How to calculate Activity Based Costing & What is the formula for Activity Based Costing?

After identifying all the support activities and associated costs & factors that drive those cost, managers at Danone can take following steps to conduct ABC costing -

Step 1- Establishing Cost Pool for each activity based on the Food Processing dynamics.

Step 2 - Allocating total cost associated with each activity to the relevant pool.

Step 3- Calculating Per Unit Cost based on the relevant cost driver.

Step 4 Final Step - Dividing the amount in each pool by estimated total usage of the cost driver. Then the unit cost is multiplied by the number of units of the cost driver of that specific product.

You can easily follow the above four steps in the following table of ABC Calculations.

ABC Calculations

Download Danone Drivers

| Overhead Cost | Driver | (a) Standard Diver Volume | (b) Custom Diver Volume | (c) Total Diver Volume a+b | (d) Costs USD | (e) Driver Rate (d/c) | (f) Standard Total Cost a*e | (g) Custom Total Cost b*e | Standard Unit Costs | Custom Unit Costs |

|---|---|---|---|---|---|---|---|---|---|---|

| Set Up Costs | Set-up per Batch | 12 | 720 | 732 | 72518 | 99.068306010929 | 1188.8196721311 | 71329.180327869 | 0.098493759082945 | 6.4202682563338 |

| Special part handling cost | Special Parts per unit | 12070 | 44440 | 56510 | 60395 | 1.0687488940011 | 12899.799150593 | 47495.200849407 | 1.0687488940011 | 4.2749955760042 |

| Customer invoicing cost | Invoices per year | 50 | 240 | 290 | 29303 | 101.04482758621 | 5052.2413793103 | 24250.75862069 | 0.41857840756507 | 2.1827865545175 |

| Material handling cost | Number of Batches | 12.07 | 222.2 | 234.27 | 62160 | 265.33487002177 | 3202.5918811628 | 58957.408118837 | 0.26533487002177 | 5.3066974004354 |

| Other overheads | Labor Hours | 24140 | 27775 | 51915 | 107613 | 2.0728691129731 | 50039.060387171 | 57573.939612829 | 4.1457382259463 | 5.1821727824328 |

Per Unit Overhead Cost using ABC

There are two steps to calculate per unit overhead costs using ABC method. First calculate per unit cost based on cost driver usage by specific product and then add those overhead costs for the product to arrive at Per Unit Overhead Cost of a product

| Overhead Unit Cost | Standard | Custom |

|---|---|---|

| Set Up Costs | 0.098493759082945 | 6.4202682563338 |

| Special part handling cost | 1.0687488940011 | 4.2749955760042 |

| Customer invoicing cost | 0.42 | 2.18 |

| Material handling cost | 0.26533487002177 | 5.3066974004354 |

| Other overheads | 4.1457382259463 | 5.1821727824328 |

| Total Overheads | 6 | 23.37 |

The total overheads of standard unit using ABC costing is 6 and the overheads of custom unit uning ABC costing method is 23.37

Total Cost Using ABC Technique

The total cost per unit of standard and custom product can be calculated by adding up - direct cost, raw material cost, and ABC derived per unit indirect cost.

| Standard Product | Custom Product | |

|---|---|---|

| Direct Costs | ||

| Labor Hours * Cost of Labor per Hours | 16 | 20 |

| Material | 22 | 32 |

| Indirect Costs | ||

| ABC- Overhead | 6 | 23.37 |

| Total Costs Per Unit (1+2+3) | 44 | 75.37 |

The Total Cost per unit of Standard product is 44

The Total Cost per unit of Custom product is 75.37

If we compare the total costs using traditional method and ABC method, we can easily observe that the difference between the total cost of custom product to that of standard product is far higher under ABC method than it is under the tradtional method.

Return on Sales Using ABC Costing Analysis

| Standard Product | Custom Product | |

|---|---|---|

| USD per Unit | USD per Unit | |

| Selling Price | 64 | 90 |

| Total Cost | 44 | 75.37 |

| Profit | 20 | 14.63 |

| Return on Sales | 31.25 | 16.259 |

The profit per unit of standard product is higher than custom product under ABC technique.By comparing the Return on Sales numbers under both traditional and ABC technique - We can easily conclude that ABC is far more effective costing technique for Danone as it stops inefficient allocation of costs to Standard product. Danone should focus on standard product rather than custom product as standard product is delivering much higher returns on sales.

Limitations of ABC Costing Method

ABC is time consuming and costly.

Setup costs and updating cost for example in the automobile industry is very high and ABC fails to inculcate it.

Business with similar product and services output that require similar activities then the benefits from ABC are very limited.

A PHP Error was encountered

Severity: Notice

Message: Undefined variable: mark4p

Filename: frontend/abccoanalysis.php

Line Number: 1002

Backtrace:

File: /var/www/embapro.com/public_html/application/views/frontend/abccoanalysis.php

Line: 1002

Function: _error_handler

File: /var/www/embapro.com/public_html/application/controllers/Frontpage.php

Line: 133

Function: view

File: /var/www/embapro.com/public_html/index.php

Line: 315

Function: require_once

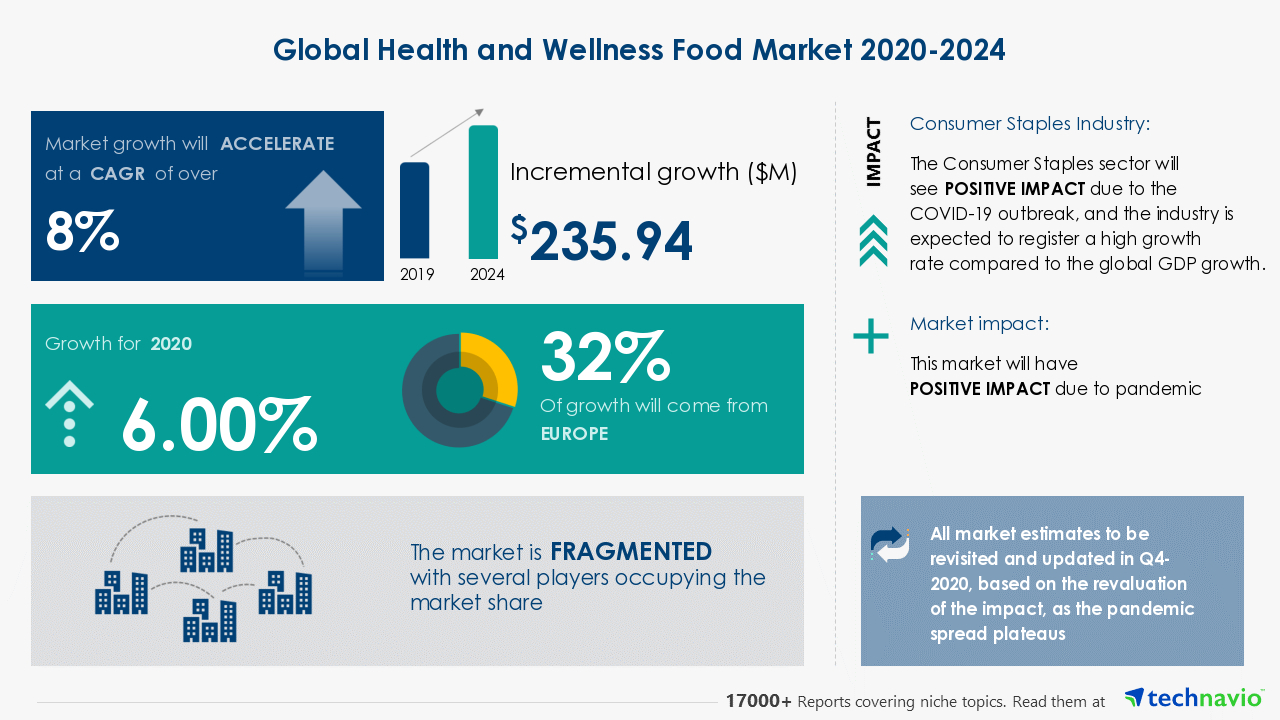

LONDON--(BUSINESS WIRE)--The probiotics market is poised to grow by USD 31.28 billion during 2020-2024 progressing at a CAGR of 8.50 % during the forecast period.

The report on the probiotics market provides a holistic update, market size and forecast, trends, growth drivers, and challenges, as well as vendor analysis.

The report offers an up-to-date analysis regarding the current global market scenario, latest trends and drivers, and the overall market environment. The market is driven by the health benefits of probiotics.

Technavio suggests three forecast scenarios (optimistic, probable, and pessimistic) considering the impact of COVID-19.Download Free Sample Report on COVID-19 Recovery Analysis

The probiotics market analysis include product segment, end-user segment, and geographic landscapes. This study identifies the increasing demand from the aging population as one of the prime reasons driving the probiotics market growth during the next few years.

This report presents a detailed picture of the market by the way of study, synthesis, and summation of data from multiple sources by an analysis of key parameters.

The probiotics market covers the following areas:

Probiotics Market Sizing

Probiotics Market Forecast

Probiotics Market Analysis

Companies Mentioned

- BioGaia AB

- Chr. Hansen Holding AS

- Danone SA

- DuPont de Nemours Inc.

- Kerry Group Plc

- Lifeway Foods Inc.

- Nestle SA

- PepsiCo Inc.

- Probi AB

- Yakult Honsha Co. Ltd.

Key Topics Covered:

Executive Summary

- Market Overview

Market Landscape

- Market ecosystem

- Value chain analysis

Download Danone Driver Download

Market Sizing

- Market definition

- Market segment analysis

- Market size 2019

- Market outlook: Forecast for 2019 - 2024

Five Forces Analysis

- Five Forces Summary

- Bargaining power of buyers

- Bargaining power of suppliers

- Threat of new entrants

- Threat of substitutes

- Threat of rivalry

- Market condition

Market Segmentation by Product

- Market segments

- Comparison by Product

- Probiotic functional food and beverage - Market size and forecast 2019-2024

- Dietary supplements - Market size and forecast 2019-2024

- Animal feed - Market size and forecast 2019-2024

- Market opportunity by Product

Market Segmentation by End-user

- Market segments

- Comparison by End user

- Human probiotics - Market size and forecast 2019-2024

- Animal probiotics - Market size and forecast 2019-2024

- Market opportunity by End user

Market Segmentation by Distribution Channel

- Market Segments

Customer landscape

- Customer landscape

Geographic Landscape

- Geographic segmentation

- Geographic comparison

- Europe - Market size and forecast 2019-2024

- APAC - Market size and forecast 2019-2024

- North America - Market size and forecast 2019-2024

- MEA - Market size and forecast 2019-2024

- South America - Market size and forecast 2019-2024

- Key leading countries

- Market opportunity by geography

- Market drivers

- Market challenges

- Market trends

Vendor Landscape

- Landscape disruption

Vendor Analysis

- Vendors covered

- Market positioning of vendors

- BioGaia AB

- Chr. Hansen Holding AS

- Danone SA

- DuPont de Nemours Inc.

- Kerry Group Plc

- Lifeway Foods Inc.

- Nestle SA

- PepsiCo Inc.

- Probi AB

- Yakult Honsha Co. Ltd.

Appendix

- Scope of the report

- Currency conversion rates for US$

- Research methodology

- List of abbreviations

About Us

Download Danone Driver Job

Technavio is a leading global technology research and advisory company. Their research and analysis focuses on emerging market trends and provides actionable insights to help businesses identify market opportunities and develop effective strategies to optimize their market positions. With over 500 specialized analysts, Technavio’s report library consists of more than 17,000 reports and counting, covering 800 technologies, spanning across 50 countries. Their client base consists of enterprises of all sizes, including more than 100 Fortune 500 companies. This growing client base relies on Technavio’s comprehensive coverage, extensive research, and actionable market insights to identify opportunities in existing and potential markets and assess their competitive positions within changing market scenarios.

Comments are closed.